Meetketchup

Board Rep

- Joined

- Mar 8, 2018

- Messages

- 10,533

- Reaction score

- 27,099

- Points

- 121

Guys, it's all in the charts and basic econ 101 knowing about tariffs/money supply/interest rates. Learn how to read them, especially longer time frames starting at Weekly, then work your way down to 5D, 3D, D, 4Hr, 1Hr.

Once you know the long-term environment you can react to the short-term moves. This is for day trading and or DCA'ing.

More pain to come showing in every indicator - RSI, Money Flow, Stochastics, Momentum Waves, etc.

Find your trend lines, support and resistance and set limit orders at these areas in case we get a massive wick.

DO NOT USE LEVERAGE IN THE CURRENT MARKET. You will get wrecked. Day trade with large sums for short term trades, but mostly this is the time for long-term buying when we get there.

Be patient!

Once you know the long-term environment you can react to the short-term moves. This is for day trading and or DCA'ing.

More pain to come showing in every indicator - RSI, Money Flow, Stochastics, Momentum Waves, etc.

Find your trend lines, support and resistance and set limit orders at these areas in case we get a massive wick.

DO NOT USE LEVERAGE IN THE CURRENT MARKET. You will get wrecked. Day trade with large sums for short term trades, but mostly this is the time for long-term buying when we get there.

Be patient!

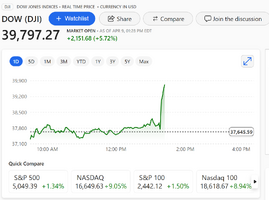

it just keeps falling and falling

it just keeps falling and falling